Massachusetts’ Disinvestment in Higher Education: A Closer Look at State Aid, Tuition Rates, and Student Debt

Click to download this issue paper

Executive Summary:

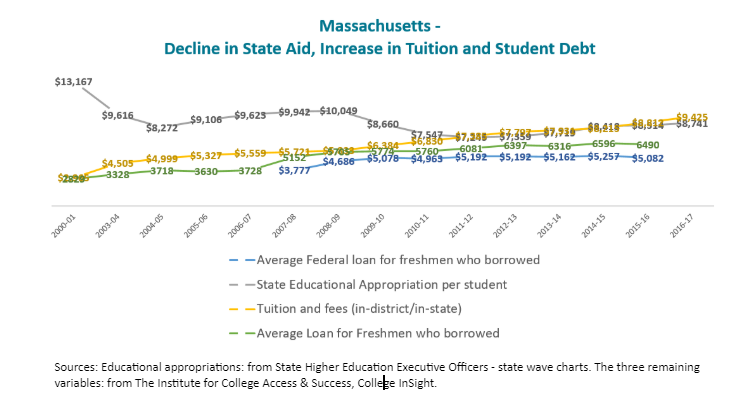

Massachusetts has experienced deep cuts in higher education funding in the last two decades. This has resulted in significant tuition increases and one of the fastest growing student debt burdens in the nation. State aid funding, tuition rates, and student debt are intrinsically interconnected. By failing to adequately fund our public higher education, we are denying our residents an affordable path to obtaining a college degree and saddling them with debt that will burden them for much of their adult life.

A recent report by the Massachusetts Budget and Policy Center [1] points out several major data trends:

Since 2001, MA higher education spending has decreased by 32 percentper student.

Average tuition and fees at MA public four-year institutions have more than doubled after adjusting for inflation — a rate of increase exceeding two-thirds of all states.

The share of graduates of public universities who have student loans increased from 58 percent in the 2003–4 academic year to 73 percent in 2015–16.

The average Massachusetts graduate student loan grew by 77 percent — faster than all but one other state.

The average student debt for graduates of MA state universities and UMass system has increased to $30,248, only 7 percent more than the debt accrued by those in private non-profit sector universities.

As Federal undergraduate loans are capped, students are increasingly reaching their maximum eligibility and are forced to borrow private loans, which are riskier, or turn to family for support. Our state economic and social well-being is dependent on a re-commitment to adequately funding quality public higher education. We must act now.

In the last two decades, Massachusetts experienced a sharp decline in state appropriation for public higher education which coincided with an increase in enrollment resulting in a 32 percent decrease in higher education spending per student [2]. This has had a direct impact on tuition and fees, which have more than doubled at public four-year institutions across the state.

As the cost of attending our public colleges and universities grew astronomically, the share of students borrowing to finance college rose from 58 percent in 2003 to 73 percent in 2015 [3]. The amount of debt they took on also grew at a pace that is faster than all other states but one in the country [4].

It is important to note that even though it may appear that federal student borrowing has been tempering in the last few years (see blue line in the graph below), it is due to the fact that students are subject to a borrowing cap. As tuition continues to increase, students are reaching their maximum eligibility under the federal loan program, which forces them to borrow from other sources (see green line in the graph below). While federal loans have favorable interest rates and generous repayment plans, private loans do not.

It is clear that we have not yet fully understood or experienced the full ramifications of disinvesting in public higher education. We must realign our priorities and adequately fund our public colleges and universities before Massachusetts is forced to experience the long-term economic consequences of disinvestment in public higher education.

ENDNOTES:

[1] Jeremy Thompson, “Educated and Encumbered: Student Debt Rising with Higher Education Funding Falling in Massachusetts,” Massachusetts Budget and Policy Center, March 1, 2018, http://www.massbudget.org/report_window.php?loc=Educated-and-Encumbered.html.

2 Ibid.

3 Ibid.

4 Ibid; Original Source: TICAS. “Project on Student Debt: State By State Data.” The Institute For College Access and Success. 2017. https://ticas.org/posd/map-state-data.