What Happens When Students Max Out On Their Loan Eligibility? A New Crisis

By Bahar Akman Imboden

Student debt has ballooned in the last two decades and it is burdening an increasingly larger segment of our youth. But as tuition continues to rise relentlessly, what happens when students reach their maximum loan eligibility? At best, students give up on their “dream” college and settle for a cheaper local school. But at worst, these students must borrow private loans or are priced out of a higher education opportunity altogether.

But there is still another option for students who are fortunate to have parents willing (and qualifying) to borrow for their child’s education. With a minimum credit check, the government issues Parent Plus Loans with an annual maximum amount determined by the cost of attendance minus the financial aid received by the student (but there is no aggregate limit for Parent Plus loans).

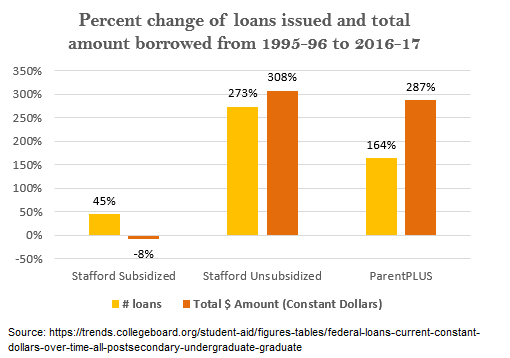

The graphs below indicate that, in the last 20 years, parents are increasingly willing or left with no choicebut to borrow for their children’s higher education dreams. The volume of parent plus loans has increased by a staggering 278% in constant dollar (510% in current)! The number of parent loans issued has rose by 164%.

Currently, the average parent loan per year is $16,000. Over four years, this amounts to $64,000. While parents may choose to delay payments until their child graduates, but interest accrues over the years, which will be capitalized (being added to the principal) and creates a significantly larger loan balance. As Parent Plus loans are ineligible for income-based repayment plan options, we should brace ourselves for a larger of segment of aging parents crushed by this debt. This will inevitably have a negative impact on retirement savings, health, and their elderly years in general.

It is clear that college debt is increasingly burdening our society. At the Hildreth Institute, we urge families to rethink whether a loan is the instrument to finance for higher education.

We need to recognize that a financial aid system based on loans is fundamentally unjust -the risk are higher for students coming from disadvantageous background, and the burden is disproportionately higher for low-income households.

While the minimum credit requirements on Parent Plus Loans are meant to protect financially vulnerable parents, their availability reinforces and perpetuates existing inequalities. If we want higher education to be a path for social mobility, it is time that we seriously question our loan-based financial aid system and re-design a better, more just, and fair financial aid system.